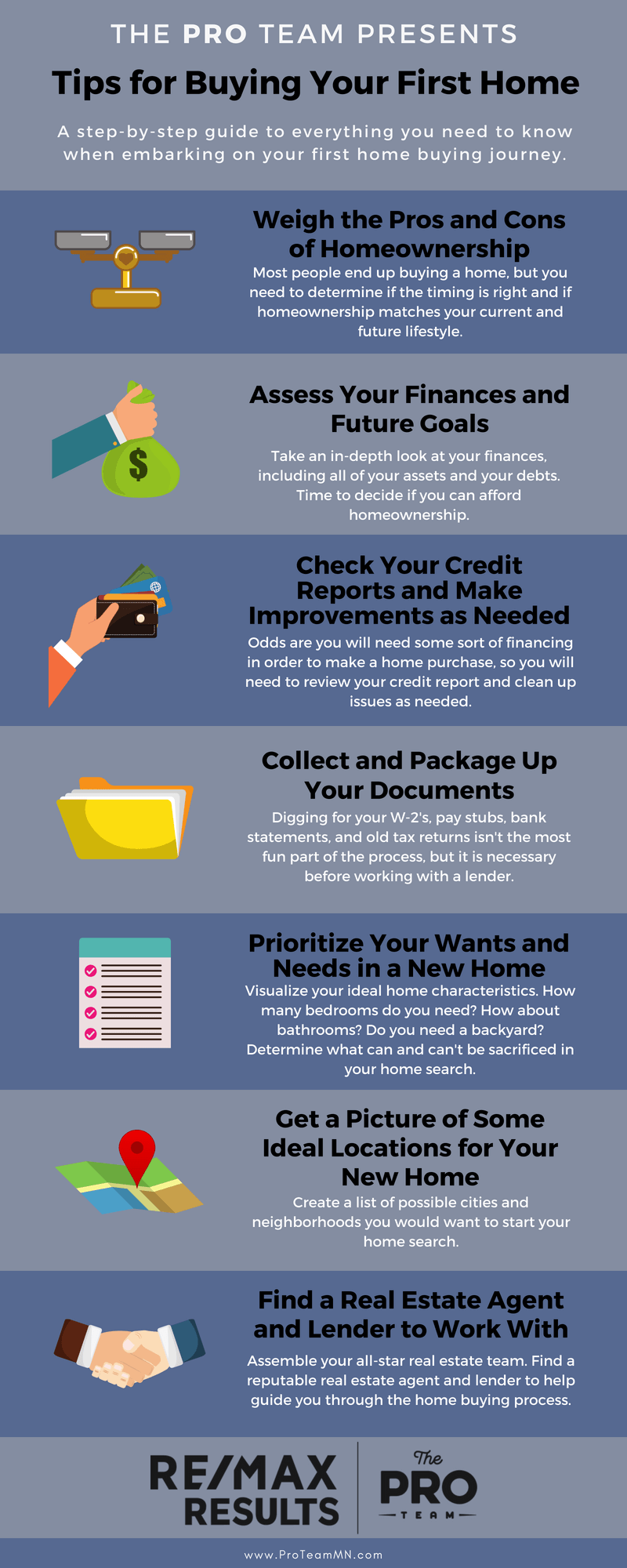

It’s an exciting time in life when you decide to move out of your childhood home and get your own place. In the rush to move in to your new home, however, a myriad of factors are often overlooked. These include researching the housing market, securing finance, ensuring the home is close to amenities and ensuring the home has all the features you are looking for, among many others. Don’t fret, though. Read on and you will learn precisely what to look for when purchasing your first home.

Do Your Research

Before searching for your first home, it would be prudent to research the housing market. Analyse current trends in the area you wish to buy. Research factors such as how many homes have sold in your chosen area in the past year, the median price homes are being bought and sold for in the area, and the resale value of the home you are looking to purchase. Armed with current, accurate information, you will be in a much better position to search for your ideal first home.

State of Play

The next step in buying your first home is securing finance. However, before setting foot inside a bank, ensure you have a clear idea of the state of your personal finances. You should determine exactly what you can afford to repay (each week, fortnight or month) and still live comfortably. Do not limit yourself to the offer from the first lender you deal with. It would be a prudent move to seek multiple opinions to ensure you receive the best deal. If you don’t feel comfortable dealing with lenders yourself, seek the help of a money-savvy friend to help you secure the best loan for your needs.

Nearest and Dearest

After securing finance, you will have a clearer idea of what you can afford. The amenities you need will largely depend on your current life stage. If you are a young, single professional, for instance, access to reliable public transport and proximity to town will be paramount; whereas, if you are a young family, proximity to hospitals and schools is very important. Also take into account whether there are any planned roadworks or developments near your potential future home; these can take up to years to complete and may seriously affect your quality of life. It’s always best to have all your bases covered when it comes to such a big investment.

Home Improvements

Once you have purchased your first home, there will undoubtedly be some modifications you wish to make. For instance, if you have a penchant for entertaining, you will plan renovations to extenuate your backyard entertainment area. To see just what you can do with your future outdoor space, get in touch with a professional builder.

Now that you are armed with the correct tools, the purchase of your first home does not need to be a case of buyer’s remorse. What other factors should you take into consideration? Have you recently bought a new home? What do you wish you had done?