So, you’ve been turned down for a credit card and you’re feeling about as low as a skateboarder’s underwear. You’re probably asking yourself a bunch of question. Questions like: What now? Am I doomed forever to live in credit-less land, wandering listlessly, buying things with whatever cash I have at hand, – constantly living within my means?

Secondly, after you’ve gotten over the self-pity, you’re probably starting to ask yourself why you’ve gotten turned down. Maybe you’ve lived a life on the edge, failing to pay bills on time or successfully settling debts, or maybe you’ve actually been excessively good with system. Why would they your money. Maybe you’ve never even had a loan and are querying the sanity of the turn you down for a loan, sure haven’t you always been thoroughly sensible?

Getting Turned Down Can Be Baffling

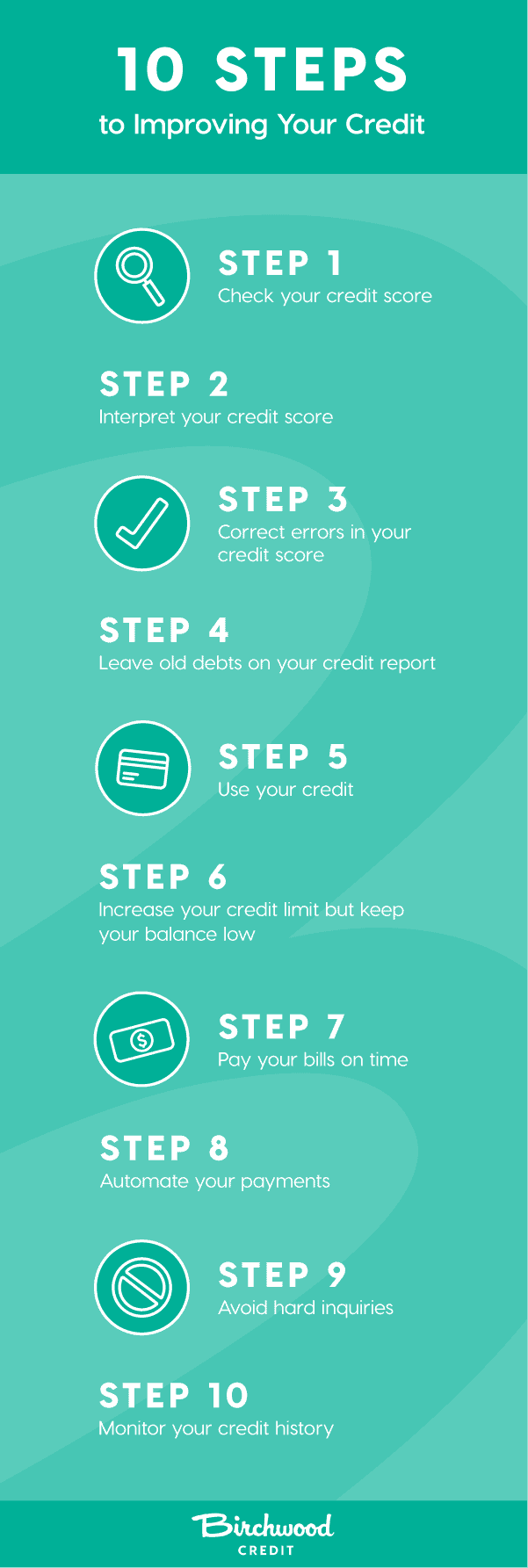

If you are a sensible Sarah, a prudent Peter or a judicious Jane (or maybe a cautious Ciara or fiscally responsible, if occasionally impulsive, Ignatius) then getting turned down for a credit card can be baffling. The first thing you should do is stop applying. The more failed attempts at getting credit, the worse off your credit score will be. What you need to do is take a gander at your credit report. You’ll have to contact one of the three credit score keepers in the UK and get them to send your login details in the post. There could be a few things wrong with it.

One, you might be not be registered on the electoral roll. Solution: get yourself on the electoral roll, stat. All of the major credit agencies take this as a sign that you are who you say you are, not being on it is a major reason your credit score will be low. Two, your account might not be open that long. Are you new to the country? Is your account less than three years old? If so, this will count against you. Solution: time travel? Short of that, there’s nothing you can do about this one. Three: you might not have much of a credit history. This is probably the biggest issue you’ll face. If you’ve never had a credit card before, then it could count against you when applying (counter-intuitive, but them’s the brakes).

No History Settling Debts

If you’ve also not had a loan then you basically have no history settling debts, which is exactly what a credit rating company is rating you on. Given that you can’t get a credit card, there is probably not a whole lot you can do here. Maybe try and get a small loan and pay it back promptly. It will do no harm to your credit score at all.

Now the alternative to having little credit history is that you might have a bad rating based on a build-up of bad debt. This is a trickier prospect and could be a deal tougher to sort out. If you have bad debt, you need to sort it out. Once there is some bad debt attached to your account there is little chance of you getting a decent credit card.

However, there are alternatives that can help fix your credit rating and give you some money to play about with in the meantime. You could apply for a retail store card, which are generally easier to get and will have a lower credit limit than your regular credit card. They do come with higher interest rates though, so be careful with your use. Another way around the issue is a secured credit card, where you pay a deposit fee up front, in case you miss a few payments. Once you prove you can manage both these cards, you’re credit rating should improve and you will be on the road to getting a full credit card in no time.

Image by Birchwood Credit

Image by Birchwood Credit