Setting up your home office can be an exciting stage in the development of your business. Get it right the first time with our tried-and-tested tips.

Plan your home office

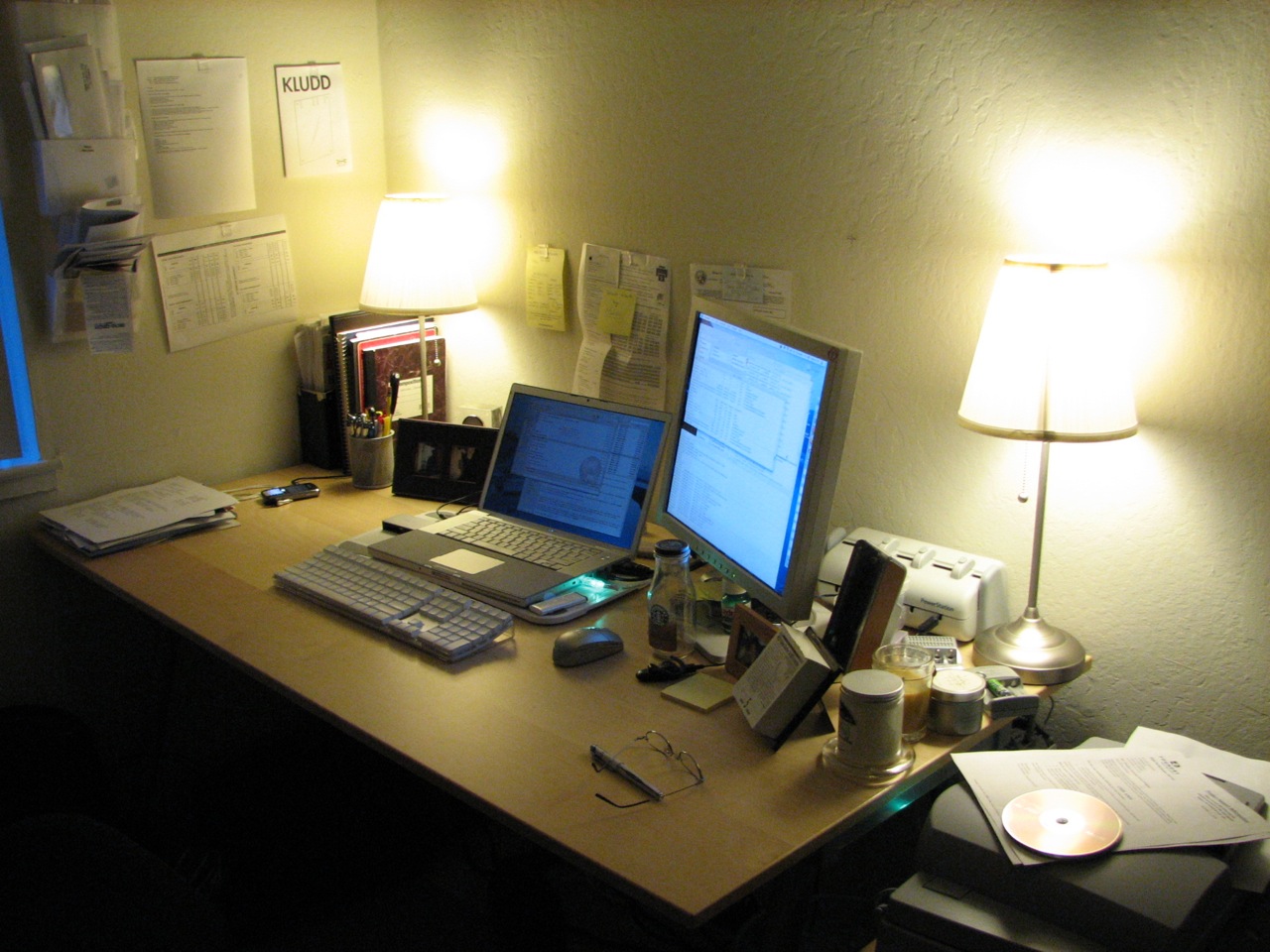

Your home office plan will cover layout and equipment, but also the flow of space. You’ll be spending a lot of time in your home office, so plan well now and reap the rewards of efficient, comfortable, ergonomic working days. Which items will you use most often? What needs to be within reach of your desk? Where should power points and technology recharging points be sited? Where does the sun come into the office at different times of day, and does this affect computer monitors? Do you need extra space for visitors or part-time workers?

Gather your home office equipment

There are certain home office items which you’ll need to invest in, such as computers, but you will find that these pay for themselves (and are a business expense). Buy the best quality that you can afford, so you won’t need to buy again for many years. You may also need a printer, photocopier or scanner (these can be combined). If your business has a lot of outgoing post, consider investing in a franking machine.

Fittings and furnishings

At the very least, you’ll need a desk, chair, shelving and lockable storage, and some extra work space. Office supplies stores will often give hefty discounts for purchases of several basic home office items, or you could check online auctions and clearance sales. Don’t forget that all of these purchases can be put through your next tax return as a valid business expense.

Get proper insurance cover

Now that you have a home office, you must be sure that you have adequate insurance cover for your office equipment, for any staff or visitors, and for yourself. Your office insurers need to be told that you now work from home, and you may need to alter your car insurance policy details, too. You should arrange public liability to cover you for your business activities which will cover visiting clients or if they visit you. Having Employers’ liability will cover you if your part or full time employees are injured during the course of the business. Speak to experts in office insurance who will be able to give you the latest advice for your total peace of mind.